There’s been much hype in 2021 around NFTs, Crypto, and the Blockchain. If you’re still not familiar with the terms, here’s a basic rundown before you jump the bandwagon.

Blockchain:

This is the foundation of all the above. In simple terms, it is a shared and distributed database that updates all the other databases when a value changes.

For a relatable imagery, imagine an excel spreadsheet that gets validated and update on every computer anytime you make a change.

Blockchain =/= Crypto. There are blockchain applications that are not related to crypto currencies – e.g. ThisFish Inc. uses blockchain to improve seafood traceability and improve transparency in the supply chain.

Crypto:

An associated token with a market value, with ownership tracked on a blockchain ledger.

2 key things to be mindful of when evaluating crypto currencies:

- Is there demand? Without demand, tokens are not “liquidate-able”. If you buy into some obscure currency or initial coin offering (ICO), the risk is much greater as you may find it harder to offload your “investment” should you need to.

- How is their blockchain network set up? Obscure tokens set up by private networks might not be true crypto – it’s hard to validate if they’re using a true distributed ledger or faking it with a centralized cloud server instead.

Effectively, investing in crypto is very much gambling (same can be said with the stock market, but with less risk since regulations reduce wild fluctuations). Instead, it’s actually more akin to Forex trading. You’re gambling on the idea that the token you own will eventually rise in demand (because it is more commonly accepted as tender/more people are buying/selling it on the speculative market) and can be liquidated at a higher value than when you initially purchased it. (You can also own fractions of a token instead of a full token)

NFTs:

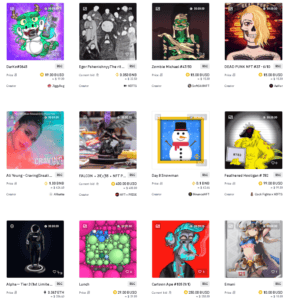

What about NFTs? Much like crypto, but instead using the ledger to track ownership of a digital asset (which is often harder to prove ownership compared to physical assets). The easy way to think of NFTs – it’s basically buying and selling art. That art could be a crypto kitty, a video clip, a tweet, a song, etc.

The weird thing is that you can through NFT, own a video/song, but technically not control it since it could be separate from distribution/licensing rights that are owned by the original creator/artist (unless it was conceded to you as part of the NFT deal).

Unlike crypto, I wouldn’t even categorize buying/selling NFTs as investing/gambling. It’s more like collectibles. If there’s any rule of thumb for success here, mimic the best practices of art collectors/collectible traders. NFTs that are rooted in pop culture are more likely to appreciate in the future when people want to collect things that give them a sense of nostalgia. Obscure items that don’t gain mainstream popularity can still appreciate if there is a strong cult-like following around them. Random 1-off items will rarely appreciate.

Thoughts? Feel free to correct me if I’m not on point.

Pingback: Advisory Email – January 2022 - ClassyNarwhal